Staking on the Ethereum Blockchain was introduced with the change of the consensus algorithm on Ethereum from Proof-Of-Work to Proof-Of-Stake. As of now, by providing Ether to validate transactions, you can receive additional ETH as a reward.

Pool-staking allows you to participate in staking with as little as a fraction of Ether, even though a minimum of 32 Ether is required. You can learn more about the possibilities with Ethereum Staking in this article.

Staking on the Ethereum network

Staking is used to secure the network by processing and validating the transaction data and then storing it into a new block. The process is thus similar to mining in a PoW system, which is currently used by Bitcoin and previously by Ethereum and other cryptocurrencies.

Instead of using computing power (hardware and energy) to validate as in the mining process, staking uses your stake of Ether to do so.

To put it simply, the higher one's stake is to the total of all staked coins, the higher the reward in staking.

The Ethereum Foundation has defined a minimum deposit of 32 Ether to activate the validator software required for staking.

Various options for staking

The minimum deposit of 32 Ether is a high hurdle to participate in staking. However, several thousand dollars are not necessary to stake, as you can get a return on your Ether even with less. The following options are available:

- Staking as a validator.

- Staking via a provider

- Pool Staking

- pool-staking via crypto exchanges.

For each method, you will get my assessment.

Staking as a validator

Solo Staking is the targeted "gold standard" of the Ethereum Foundation. You have complete control over your setup and receive all revenue from staking. This also reinforces decentralization in the network.

An Ether deposit of 32 ETH is required, which is deposited into a smart contract, to interact on the network as a validator. This is not exactly little and the setup also requires great technical knowledge of the subject matter.

Furthermore, it is recommended to keep the validator permanently connected to the Ethereum network. This requires a stable internet connection and the use of certain hardware (A Raspberry 4 is probably not sufficient for this).

In case of downtime the potential return will be reduced (although you can't lose anything by this) and in case of incorrect validation you can even lose part of your deposit (slashing).

More on the subject.

Assessment: Only suitable for experts. Time and money expenditure is worthwhile in my opinion only with significantly more than 32 Ether or the operation of several validators.

Staking via a provider

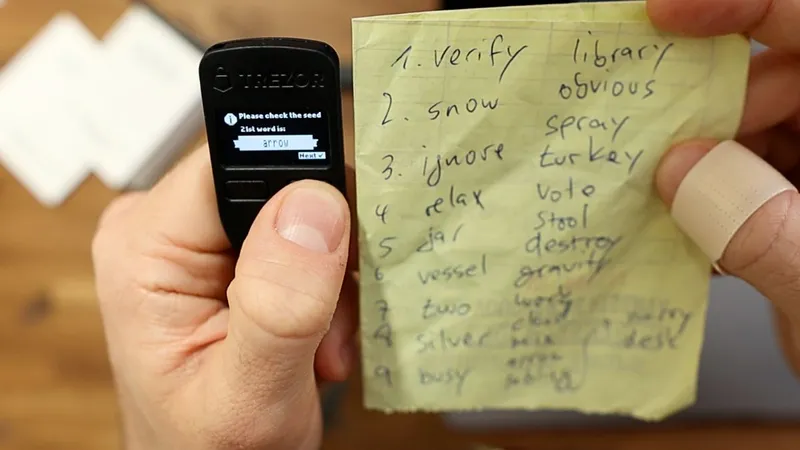

Again, a deposit of 32 Ether is required to run a validator. With this option, you hire a service provider to run the validator for you. The difficult technology is outsourced and the service provider receives a service fee for providing it. The Private Keys remain mostly in your possession.

Example Stake Fish

Example Stake Fish

The advantages here are clear. Not very time-consuming and no need to deal with the technical details and risks of staking. Most of the time the keys remain in one's own possession, which is an important difference to e.g. staking via a crypto exchange.

A disadvantage can be finding a trustworthy provider. Fees may differ from provider to provider.

Estimate: When setting up only one validator, this method is more worthwhile than solo staking. For a certain number of validators, a separate solo-staking setup might also be worthwhile if the expected return is (significantly) higher than the service provider's fees.

Pool Staking

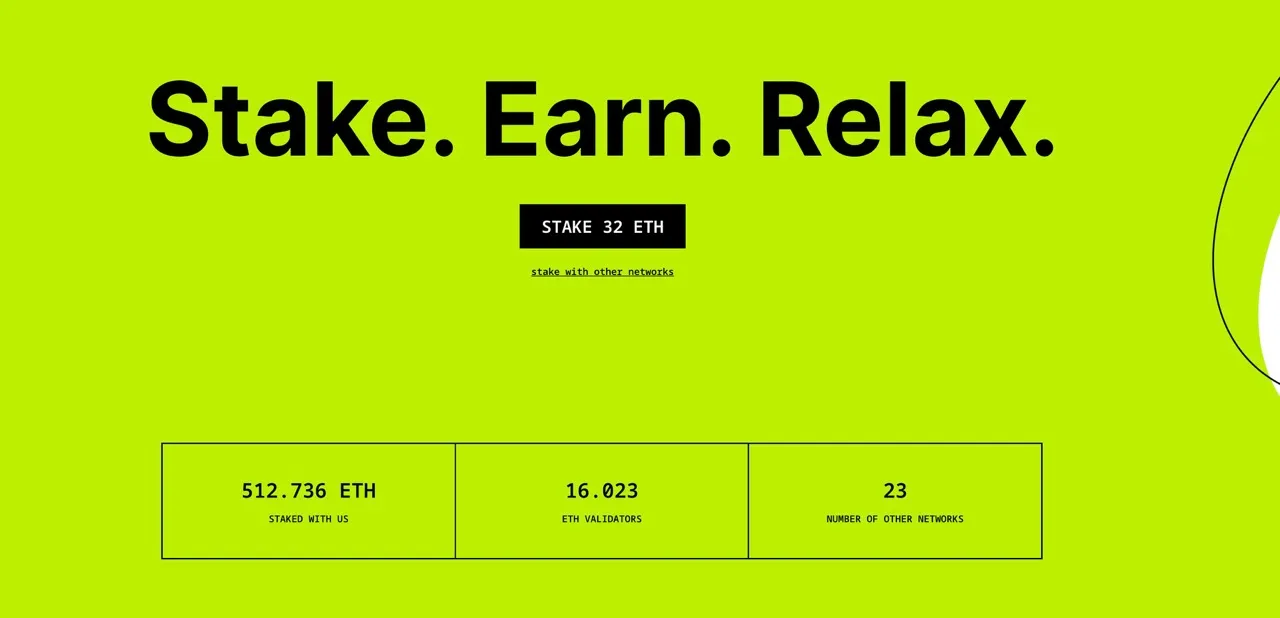

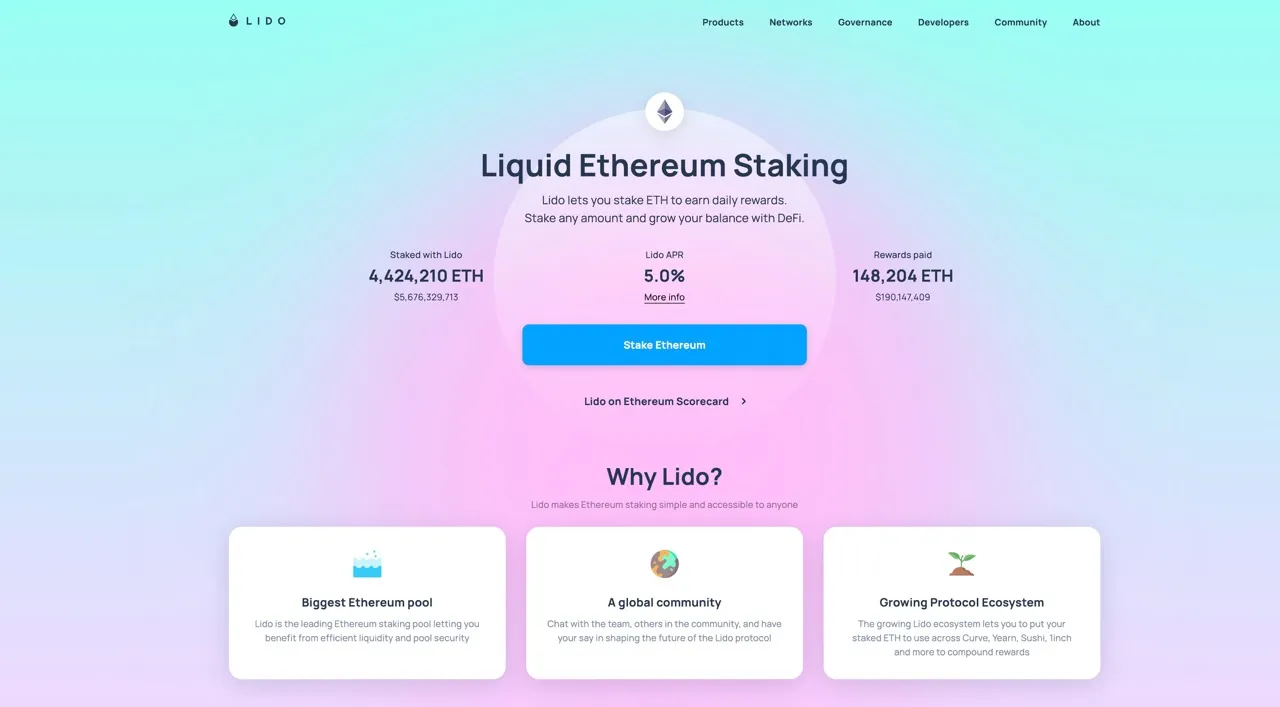

Pool Staking is the best way for most private investors to participate in Staking. No 32 Ethers are required. Multiple ETH investors can organize into a pool to jointly run their own validator. The return is distributed proportionally to all "depositors". Matching from such a pool is organized by a protocol or service provider, who takes a fee for this. Lido Finance or Rocket Pool are well-known examples.

Example Lido Finance

Example Lido Finance

Again, you don't need any technical knowledge to run a validator. The minimum deposit is less than one Ether and is determined by the protocol.

A special feature is the issuance of Ether-equivalent tokens during the staking process. By depositing into a staking pool, you receive a token in exchange, which is often supposed to represent the value of Ether 1 to 1.

With the token, you can stop pro-rata staking at any time (which is not currently possible until the post-merge upgrade) and cash out your real Ether again. Staking rewards are paid out proportionally to addresses with this token.

Through this detour, staked ETH becomes tradable and liquid, and of course, you can also use it in numerous Defi products during the process. An example of this is stETH from Lido Finance.

Special feature Rocket Pool

The token does not receive any staking income paid out, but the value of the token increases in relation to ETH instead. An aspect that could be interesting for tax treatment.

Assessment: due to the simplicity and low minimum deposit, this method is probably the best choice for most private investors. However, pooling validators in such protocols may lead to centralization in the network.

Pool Staking via Crypto Exchanges.

Another convenient way to make one's Ether deposits available for staking without a minimum deposit is to use a centralized crypto exchange. The principle works quite similarly as through pool staking only with some more disadvantages.

The centralized crypto exchange gathers several interested parties together to get the 32 Ether together for the validator. The crypto exchange then opens and runs the validator, so you don't have to worry about the technical details. For this, the crypto exchange takes a service fee.

The investor usually also receives a Token in return, which represents the value of the deposited Ether 1 to 1. Example: ETH2 at Kraken. Also, these tokens are liquid and can usually be exchanged for the real Ether at any time. However, trading is limited to the issued exchange.

Now comes the crucial disadvantage to staking compared to pool protocols. You, as the investor, do not own your private keys. This means that you are technical no longer the owner of your Ether, even if the crypto exchange promises to pay you back your Ether. In the event of insolvency or other technical failures, your holdings may be blocked or even lost (see the Celsius insolvency case).

Assessment: this method will also be the (right) choice for most private investors with less than 32 Ether. As long as it's a reputable and secure provider, you can have your Ether staked at crypto exchanges.

I would always prefer pool staking via protocols over staking via crypto exchanges, as they are more secure and also tend to contribute less to centralization in the network.

Tip: Split Ether holdings across different exchanges to minimize insolvency risk.

How much return is there?

Staking rewards are not fixed on Ethereum, but are dynamically adjusted. An important metric is a proportion of staked Ether to the total amount of all Ether in the network. If the share decreases, the reward increases. If the staker share increases, the expected return decreases.

Currently we are at approximately 4% per year. Until the post-merge upgrade, this number will continue to decrease. After the payouts of staged Ether are enabled, the return should settle at 4-5% p.a..

However, this is only the return of solo stakers with their own validators. If you use a service provider or protocol, you have to deduct the service fees from this return. There is a good overview on Staking Rewards.